The Government announced on Thursday (Jul 5) that it is raising Additional Buyer’s Stamp Duty (ABSD) rates and tightening loan-to-value (LTV) limits on residential property purchases, in an effort to “cool the property market and keep price increases in line with economic fundamentals”.

The move comes several days after official data showed that private home prices had risen to its highest point in four years in the April to June quarter, with analysts predicting that prices could soon recover to 2013 peak levels.

“The government has been monitoring the property market closely. We are very concerned that prices are running ahead of economic fundamentals,” said Mr Lawrence Wong, Minister for National Development on Thursday.

“There is a large supply of units coming on stream and interest rates are going up. We want to avoid a severe correction later, which can have more destabilising consequences. Hence we are acting now to maintain a stable and sustainable property market,” he added.

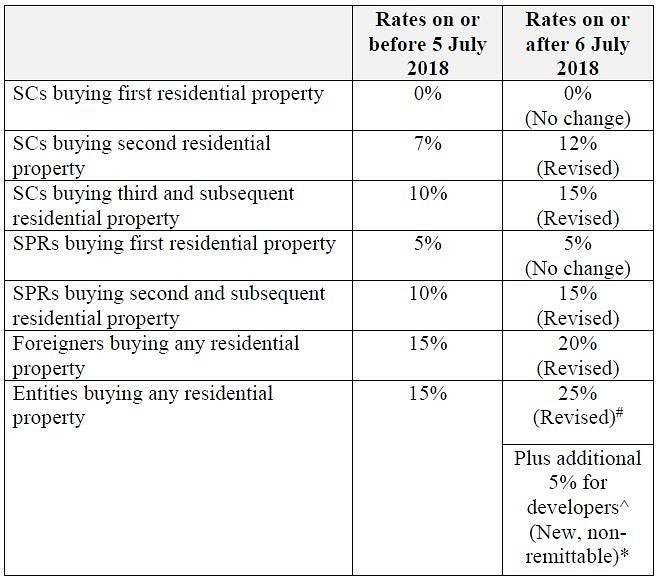

The ABSD will be raised by 5 percentage points for citizens and permanent residents (PRs) buying second and subsequent homes, and by 10 percentage points for entities, said the finance and national development ministries, as well as the Monetary Authority of Singapore (MAS) in a joint release.

There will be no change in the rates for citizens and PRs purchasing their first residential property.

An additional ABSD of 5 per cent, which is non-remittable under the Remission Rules, will also be introduced for developers purchasing residential properties for housing development.

Authorities said that for purchases jointly made by two or more parties of different profiles, the highest applicable ABSD rate will apply.

However, full ABSD remission will continue to be provided for joint purchases of the first residential property by married couples with at least one spouse who is a Singapore citizen, they added.

Married couples with at least one Singapore citizen spouse who jointly purchase a second home together can continue to apply for an ABSD refund, as long as they sell their first home within six months after the date of purchase of the second property, or by the issue date of the Temporary Occupation Permit or Certificate of Statutory Completion of the second property – whichever is earlier.

The new rates are effective Jul 6, but there will be a transitional provision for cases where an Option to Purchase (OTP) has been granted by sellers to potential buyers on or before Jul 5.

LOAN LIMITS

Meanwhile, LTV limits will be tightened by 5 percentage points for all housing loans granted by financial institutions, the release stated. The revised limits will not apply to loans granted by the Housing & Development Board.

Before the change, individual borrowers were able to borrow up to 80 per cent, or 60 per cent if the loan tenure is more than 30 years or extends past age 65. With the adjustment, borrowers will now only be able to borrow 75 per cent, or 55 per cent if the loan tenure is more than 30 years or extends past age 65.

The new limits will apply to loans for properties where the Option to Purchase is granted on or after Jul 6.

Authorities said that in line with this, LTV limits for mortgage equity withdrawal loans will also be tightened – 75 per cent for a borrower with no outstanding housing loan for the purchase of another residential property and 45 per cent for a borrower with an outstanding housing loan for the purchase of another residential property.

STICKING TO ECONOMIC FUNDAMENTALS

Authorities cited the recent sharp rise in private residential prices as the reason behind these moves.

“After declining gradually for close to four years, private residential prices began rising in the third quarter of 2017. Prices have increased sharply by 9.1 per cent over the past year. Demand for private residential property has also seen a strong recovery, as transaction volumes continue to rise,” the release stated.

Earlier this month, analysts observed that the market was on an “upswing trend”. One cited the large number of en bloc sales as a factor, while another expected many upcoming projects to launch at “new benchmark prices owing to the higher land costs”.

The “euphoria” in the market calls for caution, MAS managing director Ravi Menon said on Wednesday, after the release of the central bank’s annual report.

While the resurgence in property prices and rise in the number of transactions over the past year is welcome, it should not decouple from economic fundamentals, he also said.

“The sharp increase in prices, if left unchecked, could run ahead of economic fundamentals and raise the risk of a destabilising correction later, especially with rising interest rates and the strong pipeline of housing supply,” authorities said in the press release.

The Government said that to maintain a stable and sustainable property market, it would continue to monitor it and adjust its policies as necessary.

Source: CNA/hs(aj)